Risk management/Insurance

ETH Zurich's risk management covers the entire institution and takes into account both internal and external risks, using the internationally established standards for risk management ISO 31000 as its reference point. Risks are systematically and continuously identified, analysed, recorded and monitored. The comprehensive approach also recognises compliance, environmental and procurement risks. ETH Zurich risk management aims to protect the material and intangible assets essential to ETH Zurich's success, particularly its human capital, infrastructure and reputation.

The federal government's decision of 19 January 2005 commits ETH Zurich to managing risk responsibly.

The following comprise the formal basis for risk management:

- external pageFederal Act on the Federal Institutes of Technologycall_made (ETH Act, Art. 35abis)

- Ordinance on Finance and Accounting in the ETH Domain external pageArt. 21 2b (G, F, I only)call_made

- Guidelines on Risk Management at ETH and research institutes (German only)

- Art. 123/124of the ETH Zurich financial regulations

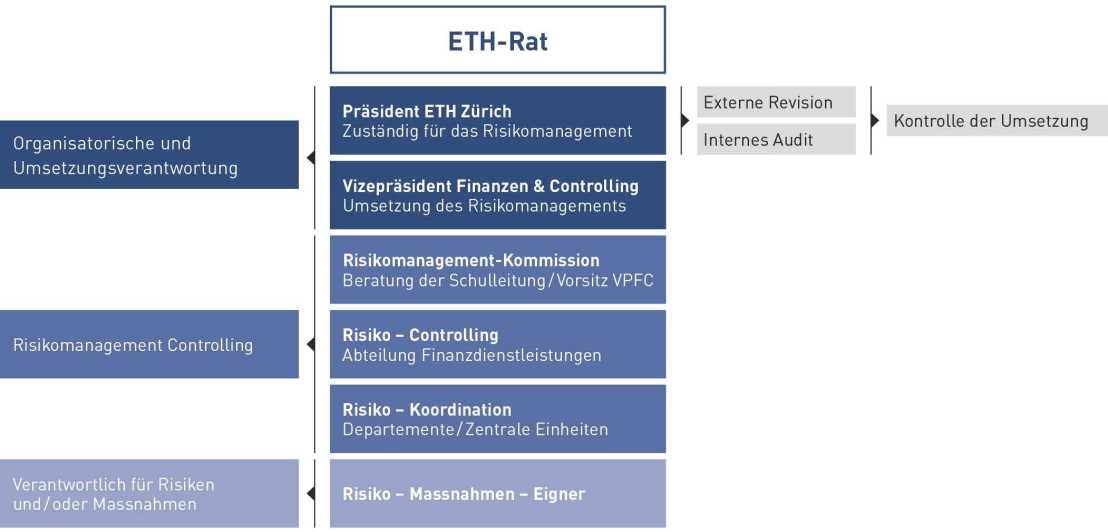

While the overall responsibility for risk management is in the hands of the President, the Vice President Finance and Controlling is responsible for its execution. The Risk Management Commission, chaired by the Vice President Finance and Controlling, advises the President and the Executive Board on matters relating to risk management, risk financing and insurance. It also determines and supervises the procedure for identifying, evaluating, handling and monitoring risk.

The Risk Management Commission advises the President and the Executive Board on matters relating to risk management, risk financing and insurance. It regularly assesses the risk, damage and insurance situation at ETH Zurich and supports the university’s various institutions in coordinating and organising risk management.

At ETH Zurich, we are proud to promote a culture of responsibility and autonomy. However, this culture can only thrive if all members comply with the statutory requirements and strictly adhere to internal directives. In view of a responsible conduct, all ETH members, and particularly those in leading positions, are required to integrate the general conditions and internal directives into the work process.

With the following tasks this culture should be supported:

- Updating compliance content

- external pagee-learningcall_made program with specific questions within the area of compliance

- Courses and trainings among others in export controll, business expenses and procurement

Contact: Yannic Kälin

Insurance contracts are concluded as a measure to avoid and minimise risk.

The Financial Services department coordinates all insurance policies apart from personal insurance.

When concluding insurance contracts, the relevant regulations on public procurement should be observed.

For further details, please click on the following topics:

Please also note the following article in the financial regulations:

Find out more

protected page lock Insurance coverIn order to prevent and combat corruption and ensure compliance with the code of conduct laid down in Article 3g of the Financial Regulations with respect to responsibility and integrity in the handling of all funds and assets entrusted to ETH Zurich, professors and employees of ETH Zurich who, in the course of carrying out their official duties, become aware of any felonies or misdemeanours at ETH Zurich that are prosecutable ex officio (e.g. criminal mismanagement, fraud, abuse of public office) are required to report the incident to their immediate line manager or the next level manager. Managers must inform the Vice President for Finance & Controlling immediately that a report has been submitted.

Other irregularities that are not classed as criminal offences (e.g. non-compliance with procurement rules, breaches of the Regulations Concerning Business Expenses, RSETHZ 245.3en; must be reported to a line manager, the Vice President for Finance & Controlling or the Ombudsperson.

If ETH bodies have clearly failed to take action without good reason, ETH Zurich employees may either refer the matter to the Ombuds Office of the ETH Board (external pagehttps://www.ethrat.ch/en/eth-board/appeals-reports/ombuds-officecall_made) or directly to the law enforcement authorities or Swiss Federal Audit Office (SFAO) (external pagewww.whistleblowing.admin.chcall_made).

Detailed rules and procedures are regulated in the Guidelines for ETH Zurich employees on reporting suspected malpractice (Whistleblowing Guidelines, RSETHZ 130.1en).