Oil Energy Realities for Western Europe (part 3): Outlook 2030

In parts 1 and 2 we concluded that the future oil consumption in Western Europe will be determined by the declining export capacity of Russia, Kazakhstan and Azerbaijan and will likely decline by 5% per year until 2018. Here, we extrapolate the maximum possible oil imports and consumption trends of Western Europe up to the year 2030.

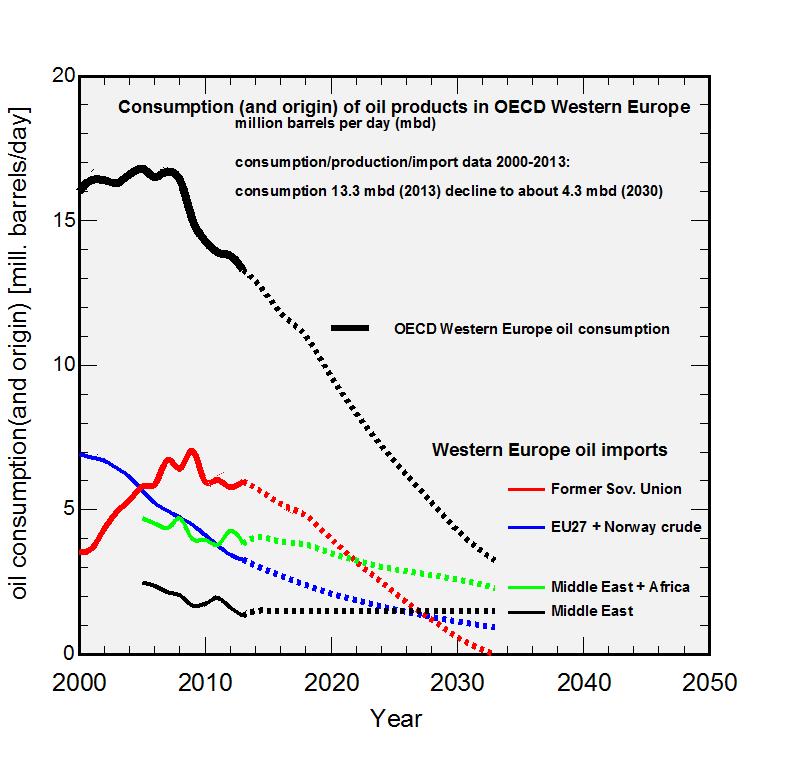

Data on 2013 oil production and consumption [1] and the surrounding media coverage confirm the conclusions drawn in part 1 and part 2. In short, oil production from the EU and Norway declined on average by another 5%, and consumption decreased by 2% to 13.3 million barrels of oil per day (mbd). The 2014 IEA oil market report [2], while “correcting” some inconsistencies between the EU import data [3] and the previous IEA report, reached essentially the same conclusion: that oil imports to Western Europe should fall in 2018/2019. Our speculation about “unknown unknowns”, e.g. the future relations with Russia, Libya and Iraq, are now echoed in the daily news.

A few basic assumptions

Using the above confirmations, one can attempt to determine Western Europe’s oil consumption trends for the next 15 to 20 years by extrapolating its internal production and oil import possibilities. This long-term estimate of future oil supply and consumption is based on some observations and a few simple and testable assumptions:

- Future oil consumption within Western Europe is determined by oil production in the North Sea and a group of countries, which taken together provided more than 90% of the oil imported by Western Europe in 2013. These countries (listed with their share of oil imports) are the former Soviet Union (FSU) countries Russia (39%), Kazakhstan (7%) and Azerbaijan (5%); the African countries Algeria (5%), Libya (7%), Nigeria (10%) and Angola (3%); and in the Middle East, Saudi Arabia (11%) and Iraq (4%). None of those countries can be considered a paradise of stability and freedom. The per capita oil consumption in these countries, excluding perhaps Saudi Arabia, is much lower than in Western Europe.

- The IEA analysis (World Energy Outlook 2013) [4], using 1,600 older crude oil fields from around the planet, finds that mature oil fields eventually decline at an average rate of about 6% per year. Without access to the detailed IEA database, we assume that annual oil extraction data from the North Sea provides a good model for future oil production in other regions. Accordingly, the terminal decline phase of 6% per year starts after a period of about five years, during which production declines by 2 to 3% per year. Therefore, the Western European oil production will continue its 6% per year decline from 3.3 mbd (2013) to about 2.4 mbd (2018), 1.7 mbd (2024) and 1.15 mbd (2030).

- The geographical location of oil fields in the Middle East and the absence of significant pipelines to Western Europe explain the IEA view that the real or imagined oil production growth in that region will mainly be exported to China, India and other Asian countries.

A closer look at Russia, Kazakhstan and Azerbaijan (FSU)

Because of space limits, only the most relevant numbers for the future oil production and consumption from Russia, Kazakhstan and Azerbaijan are presented in the following. According to the BP report [1], total oil production (including “condensates”) in these FSU states was 13.9 mbd in 2013. Subtracting the 4.6 mbd used internally, about 9.3 mbd remained for exports. About 6 mbd (65%) of this oil, with 4.1 mbd as crude and 1.9 as products, was exported to Western Europe.

The Russian finance ministry recently announced that overall Russian oil production will decline during the next several years by about 3% per year [5]. Given that significant new oil fields will only be opened in Eastern Siberia, the production decline from the existing fields – the fields that are relevant for Russia’s internal consumption and for the exports to Western Europe – should be even faster. For this estimate, we assume a 3% per year decline to 2018 and 6% afterwards. The oil production in Western Russia will thus decline from 10 mbd (2013) to 8.5 mbd (2018), 5.9 mbd (2024) and 4.1 mbd (2030).

The oil from Kazakhstan and Azerbaijan used within the FSU countries and available for exports to all countries, excluding China, was about 1.9 mbd in 2013. We assume that the production relevant for exports to Western Europe can only stay at today’s level until 2018. Afterwards, production will fall by 3% per year until 2024 and by 6% per year afterwards. Assuming only a modest increase in oil consumption within the FSU countries of 2% per year up to a maximum of 5 mbd (2018), we find the maximum export capacity from the FSU countries. Our model indicates that the oil available for export to Western Europe will decline from 6 mbd (2013) to 4.8 mbd (2018), 2.5 mbd (2024) and 0.6 mbd (2030).

Middle East and Africa

For the future imports from the Middle East we assume, in agreement with the IEA, that the EU oil imports from these countries cannot be increased and will stabilize around today’s amount of about 1.5 mbd. Taking the limited remaining resources and growing demand within the African countries into account, we expect that their oil exports to Western Europe will decrease by about 3% per year (or more) over the next 15 to 20 years. Thus by 2030, Western Europe can only import about 2.6 mbd of oil from the Middle East and Africa combined.

Western European oil consumption trends up to the year 2030

In summary, our assumptions suggest that oil consumption in Western Europe will decline due to resource constraints. This forecast decline is dominated by the falling future production within the western territory of Russia and whether it maintains its “good will” to continue its exports to Western Europe. We expect, with an uncertainty of only two to three years, that Western European oil consumption will decline in the coming years from 13.3 mbd (2013) to 10.5 mbd (2018), 7.1 mbd (2024) and 4.3 mbd (2030). One can hope that the more than 500 million people in Western Europe will find a way to share this oil “peacefully” and in such a way that we can all avoid the most dramatic hardships in the years ahead.

In part 4, I will present some related observations made this summer during “study” vacations to a country where the oil-based mobility of people and products is only 1/15 – and much less if the oil-based tourism is excluded – of the amount we are used to live in Switzerland and Western Europe.

References

[1] BP Statistical Review of World Energy 2013 and externe Seite2014call_made

[2] IEA, Medium-Term Oil Market Report 2014, Trends and Projections to 2019: externe SeiteLinkcall_made and especially page 13 in externe Seiteherecall_madeFor more information on IEA Oil Market Reports see externe Seiteherecall_made

[3] The EU oil import data for 2013 can be found externe Seiteherecall_made

[4] IEA, World Energy Outlook 2013. Executive summary: externe SeiteLinkcall_made

[5] UPI Business News: externe SeiteLinkcall_made